President Trump’s Tax Plan Faces Official Scrutiny

BY Tami Kamin Meyer

LISTEN

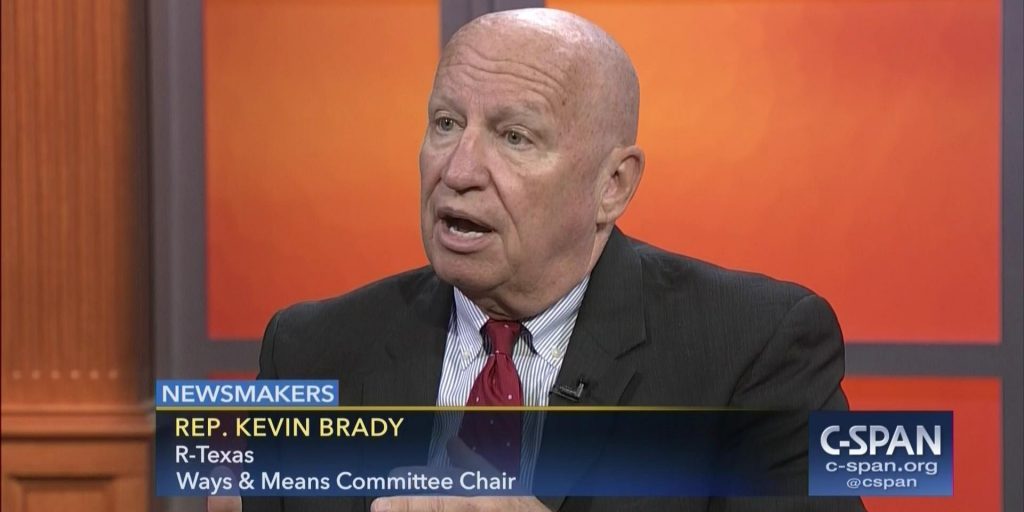

House Ways and Means Committee Releases Sweeping Tax Plan.

President Donald Trump has been promising an overhaul of the American tax laws.

The House Ways and Means Committee released its first official version of the tax plan, which is certain to face intense scrutiny from opponents, special interest groups and middle class America.

The House Ways and Means Committee’s tax reform plan released a tax plan Thursday based on President Trump’s plan revealed September 27, 2017.

The Tax Cuts and Jobs Act would lower some income tax rates, double the standard deduction and eliminate personal exemptions. Moreover, the suggested plan would reduce the corporate tax rate from 35 percent to 20 percent.

As written, The Tax Cuts and Jobs Act would reduce the current seven tax brackets to four while retaining the top rate of 39.5 percent for the highest earners. The lowest two tax brackets, currently at 10 and 15 percent would be combined, resulting in a rate increase from 10 percent to 12 percent for the lowest income earners. Those in the second bracket, who today pay 15 percent, would see rates reduced to 12 percent.

The middle rate would be 25 percent, which leaves taxes unchanged for some earners and reduces them from the current 28 percent for others.The third bracket would be taxed 35 percent, again raising the rate for some earners currently paying 33 percent while keeping rates the same for others. The top tax tier would retain the current 39.6 percent tax rate.

The proposed plan would make the following changes to the American tax structure:

| Income Tax Rate | Income Levels for Those Filings As: | ||

| Current | Tax Act | Single | Married-Joint |

| 10-15% | 12% | $0-$44,999 | $0-$89,999 |

| 25-28% | 25% | $45,000-$199,999 | $90,000-$259,999 |

| 28-39.6% | 35% | $200,00-$499,999 | $260,000-$999,999 |

| 39.6% | 39.6% | $500,000+ | $1M+ |

What is in and what is out

Itemized deductions will be severely limited by the proposed tax plan. In fact, itemized deductions are eliminated except for those on charitable contributions, mortgage interest, property taxes and retirement savings. Moreover, the mortgage deduction will apply to new mortgages of $500,000 or less.

What is out are deductions for medical expenses. Under the current plan, Americans may deduct medical expenses that eat up 10 percent or more of income.

Deductions for state or local taxes are gone, too. Research suggests 40 million Americans will be impacted by this change, primarily residents in high-tax states like California and New York. It is estimated this change would inject $1.3 trillion to federal revenues.

Good news for all is the plan doubles the standard deduction for everyone. Married and joint Filers would enjoy an increased deduction of $24,000 from the current $12,700 while the deduction for single filers would rise to $12,000 from today’s $6,300.

Meanwhile, personal exemptions will be eliminated. While current tax laws allow taxpayers to deduct $4,050 from their income for each person claimed on a tax return, the plan removes that luxury.

Estate taxes will be impacted, too. The proposed plan doubles the estate tax exemption from today’s $5.49 million to $11 million. It also phases the estate tax and the generation-skipping transfer tax in six years.

Child care deductions

Americans claiming the Child Tax Credit will benefit under the revamped tax plan because it increases the Child Tax Credit from $1,000 to $1,600. The income level is also raised, meaning more middle-income families may take advantage of the benefit.

The House’s plan also permits a $300 credit for non-child dependents.

Business tax implications

Business taxes will also be altered as the tax plan lowers the maximum corporate tax rate from 35 percent to 20. The cut is not permanent; it will last ten years. Because large American corporations can afford to pay tax attorneys who assist them in avoiding many tax liabilities, Congress decided the reduction need not be permanent.

Meanwhile, small business owners will enjoy a reduction in the maximum tax rate to 25 percent. Included in that group are sole proprietorships, partnerships and S corps. However, the reduced rate does not apply to labor-intensive businesses like law firms or financial services.

U.S. Senator Rob Portman (R-OH) expressed support for the aspects of the proposed plan that support families. “It immediately helps the family budget by cutting middle-class taxes,” he says.

In a statement issued on his web site Thursday, Portman (@senrobportman) says, “For years, Americans have called on Congress to fix our broken tax code. Chairman Brady and Speaker Ryan today released a proposal that moves us one step closer to answering that calling, and I commend them for their hard work. I look forward to reviewing the details of the House’s tax reform plan as we in the Senate continue to finalize our proposal. The Senate Finance Committee has held 70 hearings on tax reform over the last five years, and I’m looking forward to a full debate and committee consideration of our proposal in the coming weeks. It is now time to deliver results for the American people by reducing the tax burden on the middle class, helping American businesses grow and prosper, and creating better jobs and wages for our workers. We have a significant opportunity before us, and I’m optimistic we can get tax reform done.”

The proposed tax plan represents a grab bag of winners and losers, says CPA Tom Wheelwright, CEO of ProVision and the author of Tax-Free Wealth.

“The biggest losers are people in states with high income taxes and people in states where real estate prices are high. Unfortunately, those tend to be the same” places, he says. That means Americans living in states such as New York, New Jersey and California would be most impacted by the tax law’s proposal to terminate state income tax deductions. Another real property-related aspect of the tax plan is that it removes some mortgage interest deductions.

Meanwhile, says Wheelwright, “The big winners are big corporations, especially those with operations overseas.”

Small business owners, which according to the Small Business Administration comprise more than 99 percent of the American business market, do not win nor lose under the plan, says Wheelwright. “The 25 percent rate really doesn’t help them much the way the law is written. The biggest surprise is how little the plan helps small business owners who are the core supporters of the Republican Party.”

LATEST STORIES